AFTER SERVICE, WARRANTY

House Plus Housing Insurance

The liability insurance

The liability insurance for the housing defect warranty, in case a defect is discovered in your housing, allows the repair cost and other costs to be compensated by the insurance money. This is to ensure that you can purchase a new housing with security because of the insurance contract Homeland has concluded with House Plus.

The liability insurance for the housing defect warranty, in case a defect is discovered in your housing, allows the repair cost and other costs to be compensated by the insurance money. This is to ensure that you can purchase a new housing with security because of the insurance contract Homeland has concluded with House Plus.

To protect home purchasers, concerning new housing to be delivered on October 1, 2009, or later, the Act on Assurance of Performance of Specified Housing Defect Warranty obliges constructors and housing land and building dealers to implement measures to secure the means (purchase of insurance or deposit of security deposit). House Plus, as the Housing Defect Warranty Liability Insurance Corporation No. 3 designated by Minister of Land, Infrastructure and Transportation, offers House Plus Housing Insurance that complies with the Act on Assurance of Performance of Specified Housing Defect Warranty.

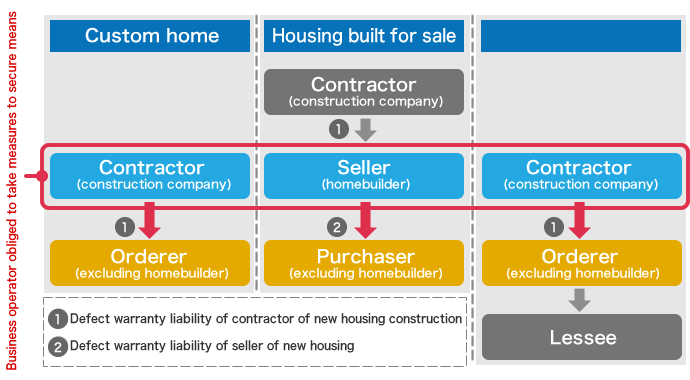

Persons subject to obligation of measures to secure means

A seller or the like is obliged to implement measures to secure the means in the event new housing is delivered to the orderer or purchaser (excluding homebuilder) who will be the owner.

A representative case is shown below.

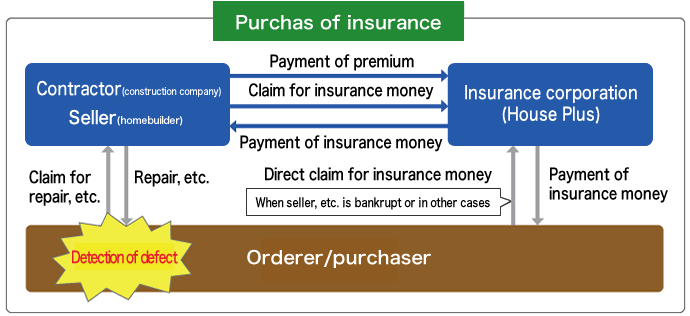

Purchase of insurance

What is the purchase of insurance (liability insurance for housing defect warranty)?

This is a system in which, in the event the seller of a new housing has concluded an insurance contract with an insurance corporation designated by the Minister of Land, Infrastructure and Transportation and a defect is found, the repair cost and other costs are covered by insurance.

To purchase the insurance, the following conditions must be satisfied.

Conditions for insurance contract

1. The seller shall pay the premium.

2. The damage shall be compensated by fulfilling the defect warranty liability of the seller, etc.

3. When the seller, etc. does not fulfill the defect warranty liability even after a long time has elapsed, the damage shall be compensated according to the claim by the orderer or purchaser.

4. The insurance amount shall be 20 million yen or greater.

5. The contract shall be valid for a period of 10 years or longer, and so on.

Direct claim by orderer or purchaser

In cases where repair is impossible because the seller is bankrupt, the orderer or purchaser can claim the insurance benefit directly from the insurance corporation.

Insurance period

The relationship between the housing type and insurance period is as follows.

| Housing type | Ownership segmentation | Insurance period |

Detached house |

Housing whose number of ownership segmentations per building is 1 | Ten (10) years from delivery of housing with insurance * In case of No. 2 insurance that insurance housing sales contract and delivery is less than two years after one year from completion of construction work, insurance will be completed until 11 years have elapsed since the construction completion date |

|---|---|---|

| Apartment house (rented accommodation)  |

||

| Apartment house (housing built for sale)  |

Housing in which a single building is divided by fixed walls and doors and the ownership is based on segmentation | From the day of delivery of each housing unit with insurance for the corresponding apartment house for sale until the day when 10 years have passed since that day, or from the day of completion of the construction until the day when 11 years have passed since that day, whichever is later. |

Scope of corresponding defect warranty liability insurance

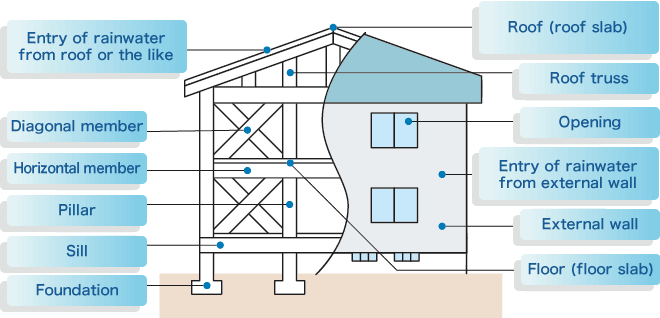

Case of detached house

Wooden structure (example: detached house build by conventional framework construction method)

The scope of the Act on Assurance of Performance of Specified Housing Defect Warranty is the defect warranty liability for the main parts from viewpoint of structural resistance and parts preventing entry of rainwater for 10 years.

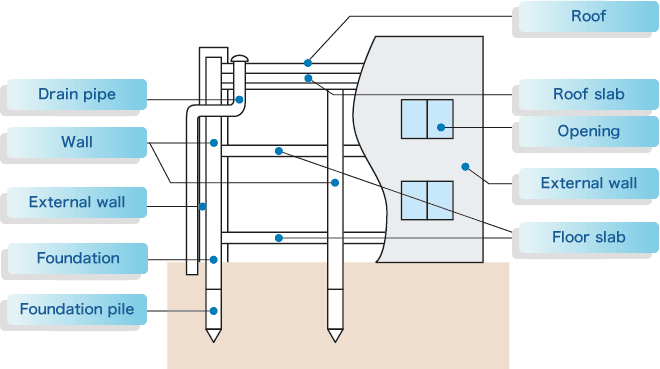

Case of Apartment house (rented accommodation)

Wooden reinforced concrete structure(Example of joint housing of wall type construction method)

The scope of the Act on Assurance of Performance of Specified Housing Defect Warranty is the defect warranty liability for the main parts from viewpoint of structural resistance and parts preventing entry of rainwater for 10 years.

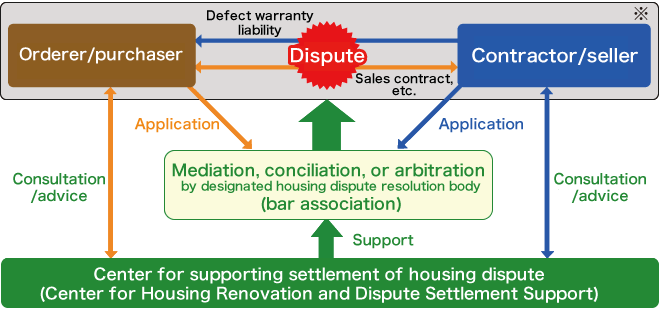

Resolution of dispute on housing subject to insurance

When a dispute arises between the contractor/seller and the orderer/purchaser concerning a new housing unit for which a liability insurance for housing defect warranty (No. 1 insurance) has been purchased, it is possible to use the dispute resolution procedures (mediation, conciliation or arbitration) by a designated housing dispute resolution body (bar association).

* In the event of a dispute concerning payment of insurance benefits regarding an accident involving a housing unit with insurance, it is possible to request the examination committee set up in the Association of Housing Warranty Insurers to conduct examination. For the details and conditions of the request, contact us.